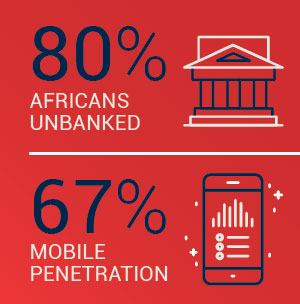

With 80% of the African population being unbanked and mobile money growing, Africa is starting to emerge as a lucrative, untapped market for global businesses to enter while there is still relatively low competition. A promising market open to the opportunities and enhanced standard of living that new financial technologies can bring. Businesses and consumers alike are in need of emerging technologies to help accelerate them forward into the digital age to bring about more economic opportunity to the wider population.

Growth in the African FinTech space has been phenomenal, particularly over the last 5 years, and the market isn’t showing any sign of saturation or slowing. Mobile penetration is at 67% on the continent and growing. While mobile payments have been the predominant FinTech solution used, market share is progressively evening out across more sectors. InsurTech and financial marketplaces are making up an increasingly bigger piece of the pie and there are tons of untapped opportunities that could lead to widespread wealth and economic upliftment

Growth in the African FinTech space has been phenomenal, particularly over the last 5 years, and the market isn’t showing any sign of saturation or slowing. Mobile penetration is at 67% on the continent and growing. While mobile payments have been the predominant FinTech solution used, market share is progressively evening out across more sectors. InsurTech and financial marketplaces are making up an increasingly bigger piece of the pie and there are tons of untapped opportunities that could lead to widespread wealth and economic upliftment

Over the last few years Mauritius has been actively positioning itself as the gateway for FinTech service providers looking to tap into the burgeoning African market. The Bank of Mauritius (BOM) and the Financial Services Commission (FSC) are the regulators that oversee the development, regulation and supervision of the FinTech services industry in Mauritius.

While the BOM supervises payment systems operators and payment service providers, the FSC is responsible for inter alia overseeing the activities of crowdfunding platforms, peer-to-peer lending operators and virtual asset service providers, FinTech products that are helping to enhance the financial inclusion agenda on the African continent.

Peer-to-Peer Lending

Peer-to-Peer (P2P) lending enables individuals or businesses to obtain loans directly from other individuals without going through a financial institution. While P2P lending is a relatively new concept in Africa, it has gained popularity in recent years as it is particularly attractive to small business owners and entrepreneurs who may not have the collateral or credit score required for traditional bank loans.

Peer-to-Peer (P2P) lending enables individuals or businesses to obtain loans directly from other individuals without going through a financial institution. While P2P lending is a relatively new concept in Africa, it has gained popularity in recent years as it is particularly attractive to small business owners and entrepreneurs who may not have the collateral or credit score required for traditional bank loans.

The Financial Services (Peer-to-Peer) Lending Rules (the P2P Lending Rules), which was issued by the FSC in August 2020, provides a modern and comprehensive framework for regulating the operations of P2P operators. A few of the salient features of the P2P Lending Rules are the requirements by the P2P Operator to:

- disclose key information relating to the conduct of its business on its website which include the platform’s applicable costs and charges, AML/CFT measures, dispute resolution process and the inclusion of two general risk statements; and

- comply with the Guidelines for Advertising and Marketing of Financial Products issued by the FSC (the Guidelines).

Additionally, in line with ensuring the soundness and stability of the financial system in Mauritius:

- the P2P operators are required to conduct due diligence on lenders from an AML/CFT perspective and on borrowers from a credit-worthiness perspective, and

- both borrowers and lenders cannot borrow and lend over a certain amount of money unless the borrower has reimbursed at least a third of the amount borrowed or a period of 12-months has elapsed since the lender lent money on the P2P platform. The lending limits however do not apply to expert investors lending through the P2P operator.

Crowdfunding

Crowdfunding is the use of online platforms to raise money for business ventures from a large base of investors. As per the World Bank’s latest statistics on the funding requirements for SMEs, it is estimated that SMEs in Africa need access to approximately USD 330 million to finance their operations and growth. In trying to close this funding gap, small businesses and entrepreneurs are turning to crowdfunding platforms to raise capital.

Crowdfunding is the use of online platforms to raise money for business ventures from a large base of investors. As per the World Bank’s latest statistics on the funding requirements for SMEs, it is estimated that SMEs in Africa need access to approximately USD 330 million to finance their operations and growth. In trying to close this funding gap, small businesses and entrepreneurs are turning to crowdfunding platforms to raise capital.

Similar to the P2P Lending Rules, the Financial Services (Crowdfunding) Rules (the Crowdfunding Rules), which was issued by the FSC in September 2021, provides a specific regulatory framework for ensuring that the crowdfunding operator, the investor and the entity seeking funding on the platform (the Issuer) are adequately protected. The Crowdfunding Rules, amongst other mandatory requirements, granularly prescribe the unimpaired stated capital requirements, the aggregate amount that can be lent and borrowed, as well as other governance and risk parameters that need to be complied with by the crowdfunding operator.

Virtual Assets

By promulgating the Virtual Assets and Initial Token Offering Services Act (VAITOS Act) in February 2022 Mauritius became amongst the first countries in the Eastern and Southern African region to adopt an umbrella legislation on the regulation of virtual assets. At a time when certain international financial centres are still weighing up whether a virtual asset amounts to a security or not, the legislator brings clarity by excluding the digital representation of securities from the purview of the VAITOS Act.

By promulgating the Virtual Assets and Initial Token Offering Services Act (VAITOS Act) in February 2022 Mauritius became amongst the first countries in the Eastern and Southern African region to adopt an umbrella legislation on the regulation of virtual assets. At a time when certain international financial centres are still weighing up whether a virtual asset amounts to a security or not, the legislator brings clarity by excluding the digital representation of securities from the purview of the VAITOS Act.

Over and above the VAITOS Act, the FSC has also issued no less than 8 rules, covering inter alia custody of client assets, capital and other prudential requirements and risk management and a host of other guidance notes.

Future forward: FinTech poised for bright horizons in Mauritius

FinTech is already helping to lift millions of Africans out of poverty. With the market for FinTech services in Africa going through a period of exceptional boom, Mauritius is already playing a vital role in acting as a launchpad for those FinTech businesses looking towards Africa.

At Imara Trust, we have already been assisting a number of entrepreneurs and international companies structure their business in Mauritius for accessing the phenomenal African FinTech market. If you would like to find out how our experienced individiuals can help you use international holding structures, special licence companies for FinTech investments and take advantage of the conducive fiscal and legislative framework in Mauritius, please contact us.